Call usHours: Mon - Fri 8:00AM - 5:30PM MST

Professional BOI Reporting Services:

Compliance Made Easy

You keep growing your business while we keep it compliant.

100% Accurate Reporting

Saves Time & Money

Risk-free Guarantee

I agree to the terms & conditions and to receiving emails and text messages regarding my entity's BOI report status.

Your Filing Process,

Step by Step:

Answer a few questions about your business and its beneficial owners.

We’ll create the report and file it for you quickly and accurately.

You’ll receive a confirmation email with a copy of your report. That's it!

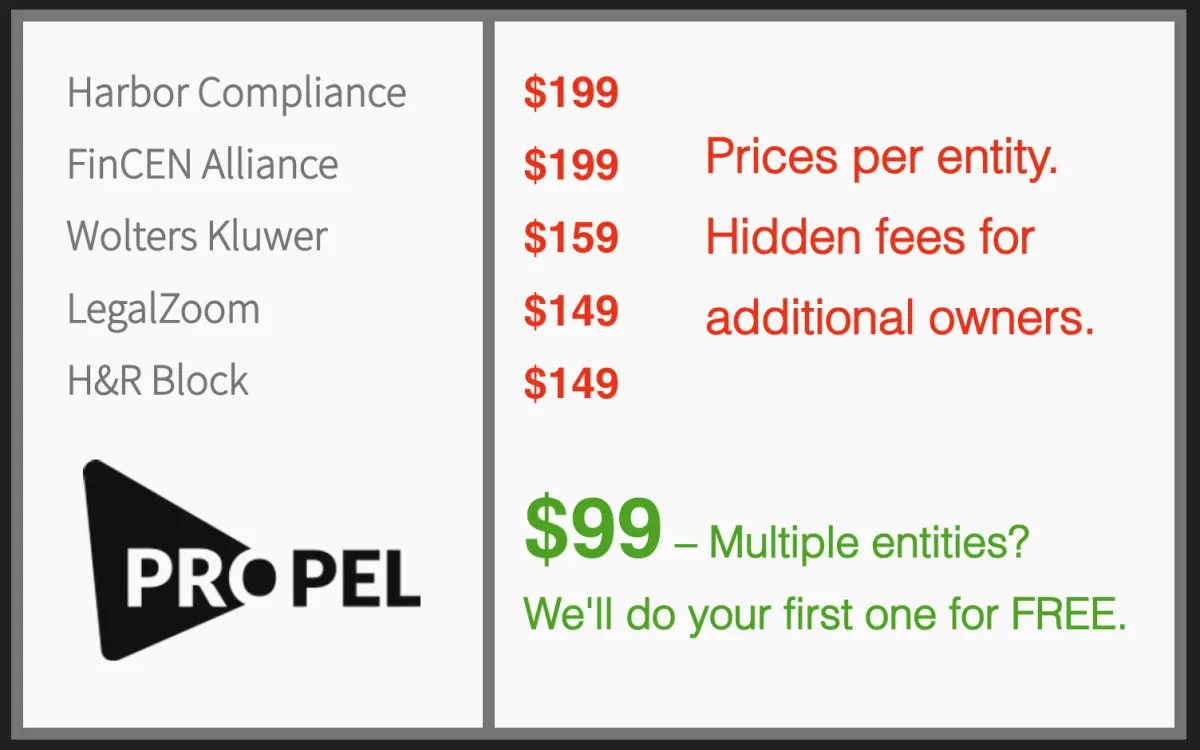

Affordable BOI Reporting for Blue Collar Businesses

Focus on what you love about business.

We'll take care of what you don't!

FAQ from FinCEN:

Is it necessary for my company to disclose its beneficial owners?

Unless falling under specific exemptions, small corporations or LLCs are likely obligated to disclose their beneficial ownership details to FinCEN. The requirement hinges on whether your company had to submit documentation to the state's secretary of state or a similar authority to establish its existence, or for foreign entities, to register for operations in the United States.

Who qualifies as a beneficial owner of my company?

A beneficial owner is defined as any individual exercising significant control over the company or possessing ownership or control of at least 25 percent of its shares.

Are there obligations for my company to disclose its company applicants?

Up to two individuals may qualify as company applicants: the individual directly filing the document establishing or first registering the reporting company, and the person primarily responsible for directing or controlling the filing process. Reporting company applicants is only mandatory if the company was established or registered on or after January 1, 2024.

What specific details does my company need to provide?

A reporting entity must furnish its legal name, any trade name or DBA, address, jurisdiction of formation or initial registration (depending on whether it's domestic or foreign), and Taxpayer Identification Number (TIN). For each beneficial owner and company applicant (if applicable), the company must provide their legal name, birthdate, address (typically a home address), and an identifying number from a driver’s license, passport, or other approved document, along with an image of the document containing the number.

When and how should my company submit its initial report?

Existing companies as of January 1, 2024, must file their initial BOI report by January 1, 2025. For companies created or registered in the U.S. between January 1, 2024, and January 1, 2025, there's a 90-day window from receiving actual or public notice of the effectiveness of their creation or registration. For those created or registered after January 1, 2025, the deadline is 30 calendar days from receiving actual or public notice of their creation or registration effectiveness.

What procedures apply to changes or inaccuracies in reported information?

Your company has 30 days to report any modifications to previously submitted information. The countdown for updates begins upon the occurrence of the relevant change, while for corrections, it initiates upon awareness or reason to know of an inaccuracy in a prior report.

Terms & Conditions | Privacy Policy

© 2024 PropelYour.com